How to read candlestick charts for beginners?

How to Read Candlestick Charts for Beginners

Intro to the topic you can actually use today: I remember I started with a simple coffee cup in one hand and a candlestick chart in the other. Candles aren’t just pretty bars; they tell a story about who was in control on a given period. Get the language right, and you’ll spot turns, pullbacks, and continuations faster than you thought possible. This guide lays out practical steps, real-world examples, and a look at how candlesticks scale from forex to crypto, stocks to commodities—and how the future of trading is evolving with DeFi, AI, and prop trading.

What candles tell you

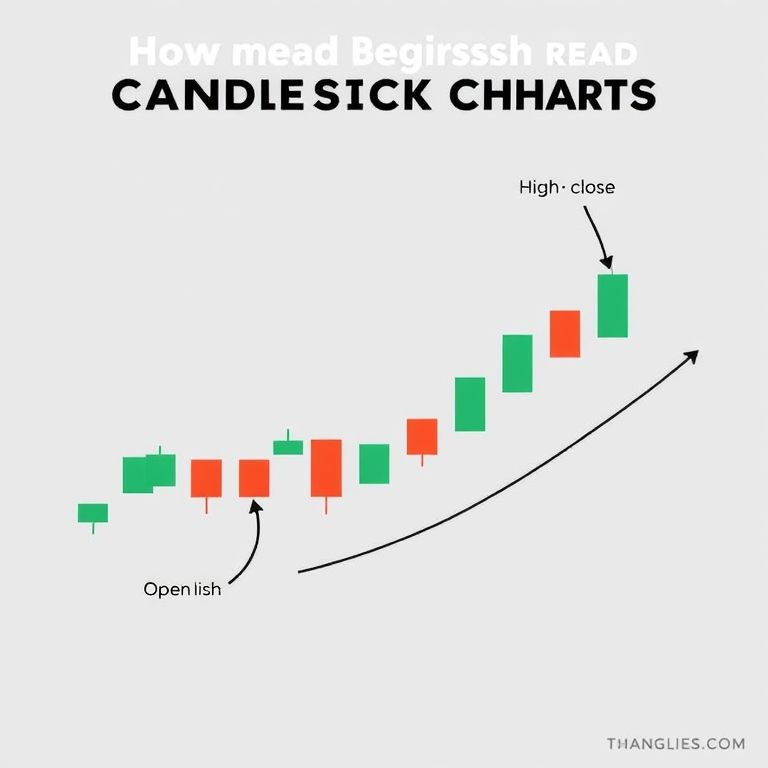

- Each candle encodes four data points: open, high, low, and close. The body shows where price opened and closed; wicks show the extremes reached during the period.

- Color matters. A bullish candle (close higher than open) usually signals buyers in control; a bearish candle (close lower than open) points to sellers dominating.

- Patterns aren’t crystal balls, but they’re useful clues. A long wick after a rally can warn of exhaustion; a solid, long bullish candle after a down day often hints at a shift in momentum.

Patterns to watch at a glance

- Doji: open and close are very close, signaling indecision—watch for a follow-through.

- Hammer and Inverted Hammer: small bodies with long lower or upper wick, suggesting potential reversal after a downtrend or uptrend.

- Bullish and Bearish Engulfing: a small candle followed by a larger opposite-color candle, hinting at a turn when they occur after a pullback.

- Early trend confirmations: a string of candles moving in one direction adds weight to the readability of a potential breakout or pullback.

A practical reading workflow

- Align timeframes. If you’re day-trading, check the 1-minute to 5-minute charts for micro-structure, then confirm on 15-minute and 1-hour charts for trend context.

- Check the trend and the pattern together. A bullish pattern in a downtrend may be a pause, not a reversal; in an uptrend, it could be a continuation signal.

- Watch volume and liquidity when you can. Bigger candles on higher volume tend to carry more significance.

- Apply basic risk rules. Define a stop based on recent swings, not just a fixed number. Aim for a favorable risk-reward ratio before you enter.

Asset classes and chart dynamics

Candlesticks work across forex, stocks, crypto, indices, options, and commodities, but volatility and liquidity shape how you read them. Crypto and small-cap stocks may produce bigger wicks and faster moves; major forex pairs often show tighter ranges but clear trend structures. In options and futures, candlesticks become clues on the underlying, while volatility and time decay add layers to your interpretation.

DeFi, smart contracts, and the challenges

- Price charts still ride on market data, but DeFi introduces new risks: smart contract bugs, front-running, and liquidity shifts can affect price discovery.

- Reading candles in DeFi pairs (tokens on DEXs or cross-chain pools) is similar, but you’ll see more flash volatility and occasional price spikes around liquidity events.

- Always account for on-chain risk besides chart signals: security, protocol incentives, and governance changes can change the landscape overnight.

Future trends: AI, smart contracts, and prop trading

- AI-driven analysis helps spot patterns across dozens of assets faster, but human judgment remains essential for context and risk control.

- Smart contracts enable automated, rules-based trading strategies; the next wave will blend on-chain signals with off-chain analysis for more robust setups.

- Prop trading is expanding as firms and funded accounts seek diversified exposure across forex, crypto, equities, and commodities. The ability to test ideas on simulated or small live accounts helps beginners evolve into disciplined traders.

A starter takeaway you can use today

- Start with a simple rule: identify the prevailing trend, spot at least one reliable candlestick pattern that aligns with that trend, and keep risk tight with a defined stop. Practice with one or two liquid pairs or assets you actually use in daily life—like your favorite stock, a major crypto pair, or a major currency pair.

Slogan: Read the candle, catch the move.

Whether you’re sipping coffee at home or grinding through a live market session, learning candlesticks is a practical gateway to a broader trading toolkit. This skill scales across assets and, with thoughtful risk controls, can open doors in prop trading and beyond.